Turning Real Assets Into Investable Tokens

Orchestrating private deals and tokenised securities with speed, governance, and Labuan compliance.

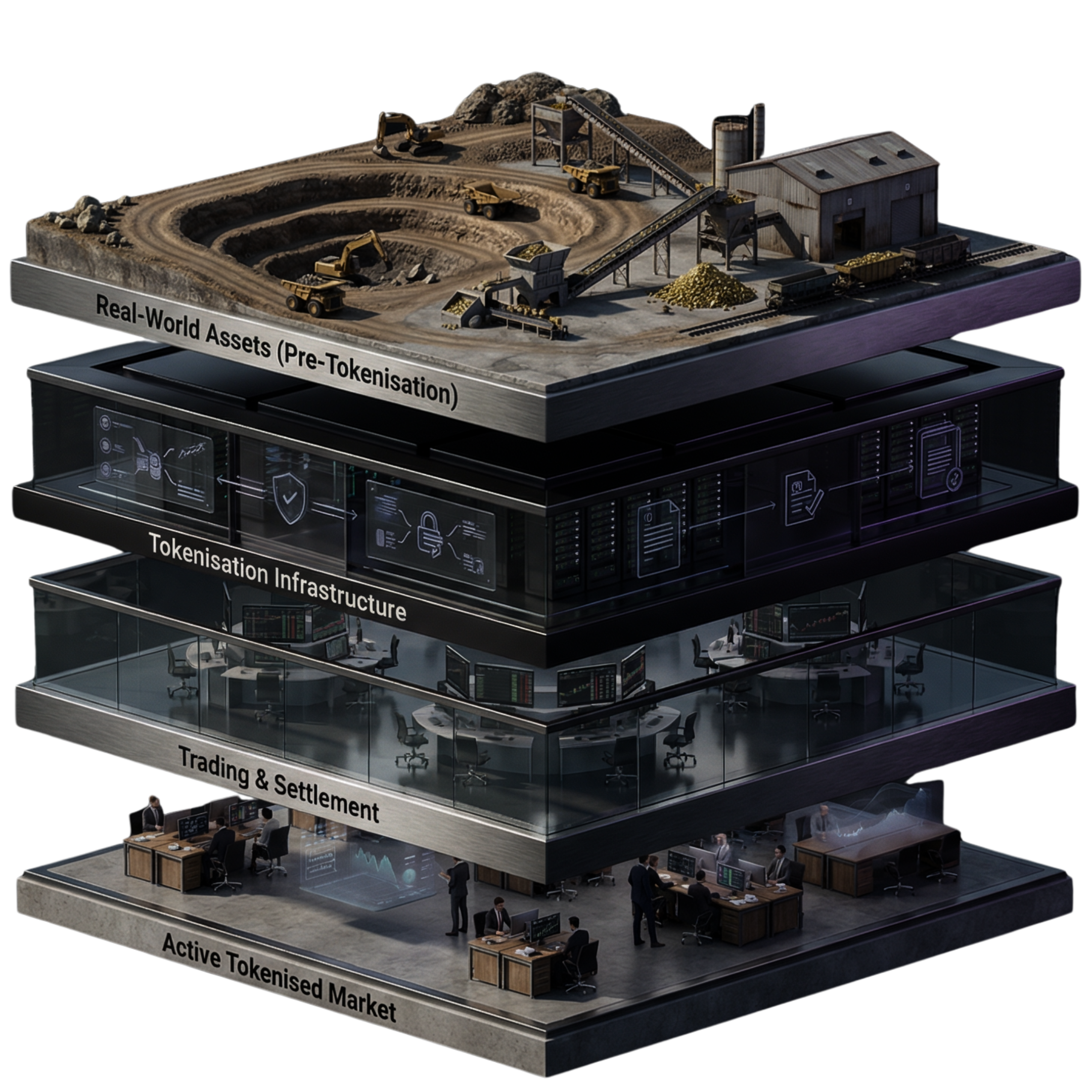

End-to-End Tokenisation Ecosystem

Real-World Assets

Unstructured projects and assets before they become investable.

Tokenisation Infrastructure

Structuring, legal documentation, compliance, onboarding.

Trading & Settlement Layer

Order management, allocations, settlement via licensed partners.

Active Tokenised Market

Live interaction, reporting, distributions and lifecycle updates.

Why Tokenize?

Instant Settlements

Transfers and trades executed through smart contracts are settled immediately, reducing transactional risks and delays.

Automated Regulation

Regulatory requirements, such as jurisdictional and transfer restrictions, are automatically enforced via smart contracts.

Enhanced Liquidity Access

Enable your shareholders to access a variety of liquidity options including borrowing and lending, trading on licensed marketplaces and P2P transfers.

Flexible Customization

Set up specific features, such as voting rights or dividend preferences, to make the management of share classes work for your organization.

Real-Time Shareholder Data

Access your shareholder register and get valuable insights on shareholder activity in real time—no more waiting for nightly database refreshes.

Our Services

Comprehensive securities lifecycle management.

Securities Advisory

Expert structuring of capital, tranching, and covenants. We translate assets into investable securities.

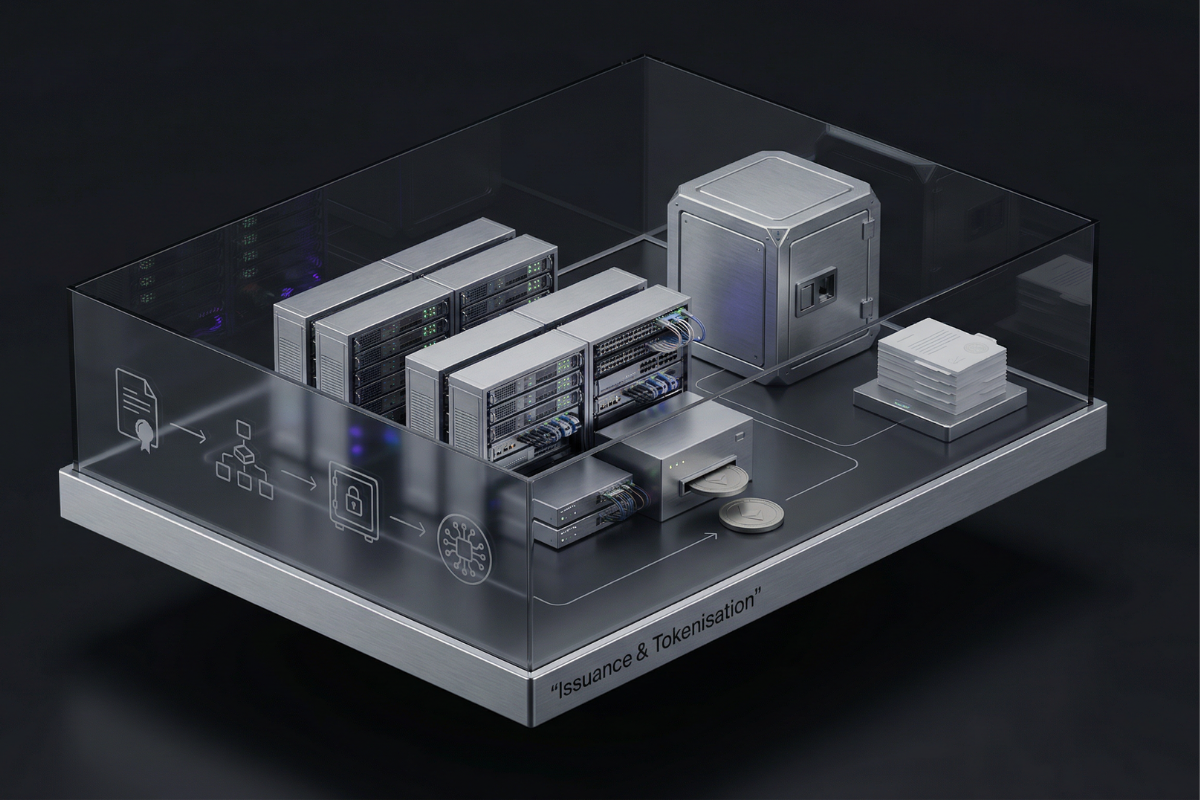

Issuance & Tokenisation

End-to-end management of term sheets, legal artifacts, and token generation via SPVs.

Private Placements

Curated deal brokerage for eligible investors. We handle allocations, confirmations, and order intent.

Lifecycle Admin

Ongoing regulatory reporting, investor register maintenance, and corporate action management.

Tokenised Deals, Delivered With Precision.

End-to-End

From term sheet to issuance, reporting & redemption

100% Non-Custodial

Client assets handled only by licensed partners

How It Works

Onboard

Complete KYC/KYB and suitability checks to qualify as a Sophisticated Investor or Issuer.

Structure

Define deal terms, covenants, and waterfalls. Prepare legal artifacts.

Issue

Execute private placement and mint tokenised representations of the securities.

Settle

Instant settlement via our licensed payment partners (INFII).

Why Clients Use ByX

Built for institutions issuing and managing tokenised securities — not retail speculation.

Structured & Governed Issuance

We specialise in structuring private deals into compliant, investable securities — with clear terms, governance, and lifecycle controls built in from day one.

One Platform, Full Lifecycle

From asset onboarding and structuring to issuance, investor management, reporting, and redemption — ByX supports the entire lifecycle of tokenised securities in one system.

Regulatory-First Architecture

Designed to operate within regulated frameworks, with KYC/KYB, investor eligibility checks, disclosures, and audit-ready records embedded at every stage.

Institutional Control & Oversight

Built for professional issuers and investors who need transparency, access control, and operational certainty — not consumer-grade tooling.

Non-Custodial by Design

ByX does not hold client money or custody client assets. Client funds and safekeeping are handled by licensed escrow, banking and custody partners — while ByX focuses on governance, documentation and lifecycle administration.

Segregated Client Accounts

Client funds are held in segregated accounts under licensed escrow or banking partners, separate from ByX operating accounts.

Clear Records & Reconciliation

Issuance and investor registers, allocations, and cashflow schedules are maintained with audit-ready records and regular reconciliation workflows.

Custody & Safekeeping Controls

Digital asset custody and asset safeguarding are handled by regulated custodians with controlled access, approvals and reporting.

Structured Distributions & Redemptions

Distributions, coupon events and redemptions follow predefined terms and timelines, administered through documented workflows.

Labuan-Regulated & Institution-Ready

A fully licensed Labuan securities intermediary for private placements and tokenised real-world assets. We structure and administer deals while licensed partners handle custody.

01. Licensed Platform

Labuan-licensed for securities dealing, investment advice, and administration.

02. Institutional Structuring

Professional term sheets and covenants meeting institutional and regulatory standards.

03. Non-Custodial Model

Assets held by licensed banks and custodians; we focus on governance.

04. Clear Governance

Full audit trails, investor registers, and transparent reporting.

Tokenisable Asset Types

ByX supports a wide range of real-world and private-market assets that can be structured, documented and issued as regulated tokenised securities.

Real Estate & Property

Commercial buildings, residential projects, hotels and land that can be fractionalised into investable, regulated units.

Infrastructure & Energy

Toll roads, data centres, solar farms and long-term concession assets with stable, contract-backed cashflows.

Private Credit & Financing

Secured loans, SME financing, bridge facilities and revenue-based financing packaged as tokenised credit notes.

Corporate Equity & SPVs

Shares in private companies, asset SPVs and profit-sharing structures converted into tokenised equity instruments.

Funds & Yield Vehicles

Private debt funds, real estate funds and structured yield products represented through tokenised investment units.

Commodities & Natural Assets

Gold, metals, energy reserves and agriculture-linked assets represented as tokenised claims on underlying value.

Structured Securities. Tokenised With Clarity.

ByX Digital Securities is a Labuan-licensed securities and capital-markets platform focused on private placements and tokenised real-world assets for sophisticated and professional investors.

We do not run a public exchange or hold client money. Instead, ByX acts as the orchestration layer – structuring deals, coordinating documentation, onboarding investors and administering each transaction through its full lifecycle, while licensed partners handle custody, escrow and payments.

OUR GOAL

"Make private-market issuance clearer, safer and easier for both issuers and investors."

Together, we bring you:

Labuan-regulated deal structures with integrated KYC/KYB and securities compliance.

End-to-end management: structuring, issuance, reporting, and lifecycle administration.

Direct connectivity to licensed custody and payment partners for fluid fiat and digital flows.

Contact Us

Tell us what you need and our team will get back to you.

Labuan Office

Suite No. 18, Unit Level 9E

Main Office Tower, Financial Park Complex

Jalan Merdeka, 87000 Labuan F.T., Malaysia